Jorge Stolfi

2021-01-16

A recent article [1] by a bitcoin advocate claims to refute the thesis that bitcoin is a ponzi. Presumably that "Article A" is the written appendix to a recent podcast of a debate between the author and myself [2].

This text is a point-by-point re-rebuttal to Article A, specifically. The reader may consider reading my own write-up, Bitcoin is a Ponzi ("Article S") [3], which is a better organized explanation of that thesis.

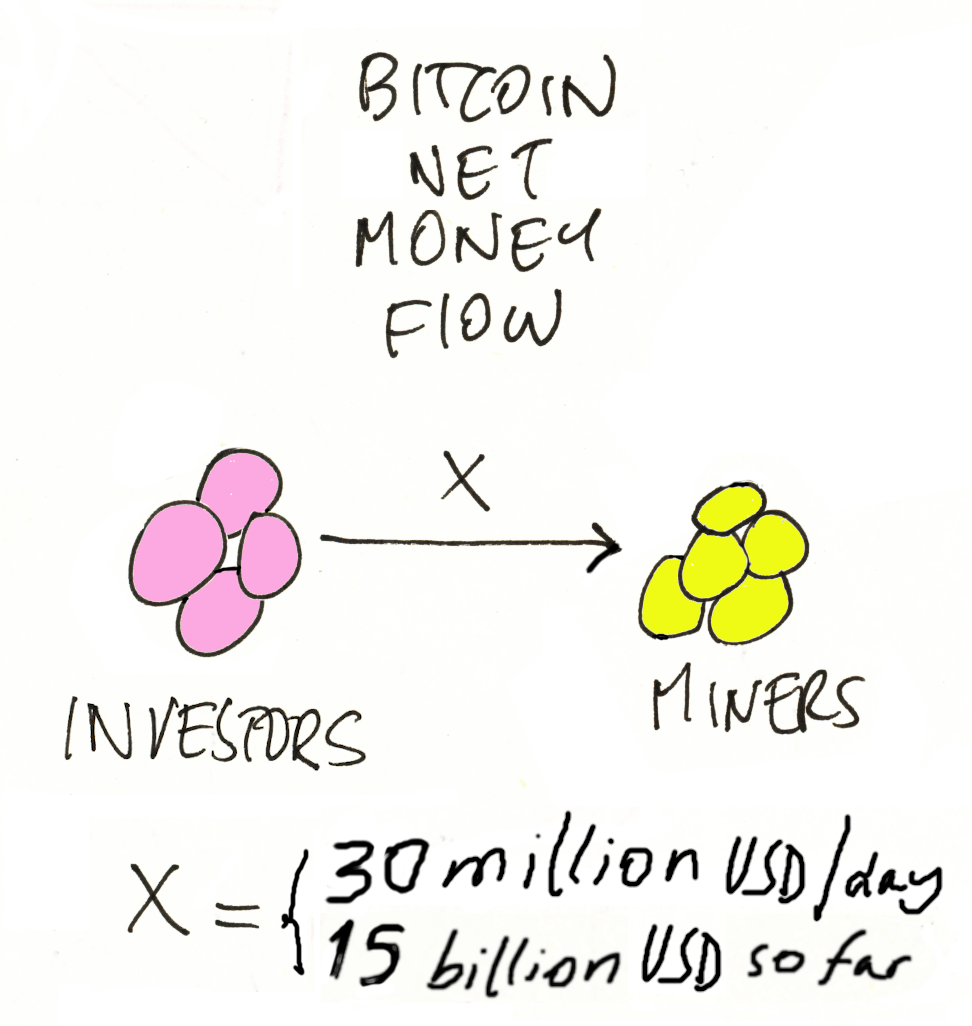

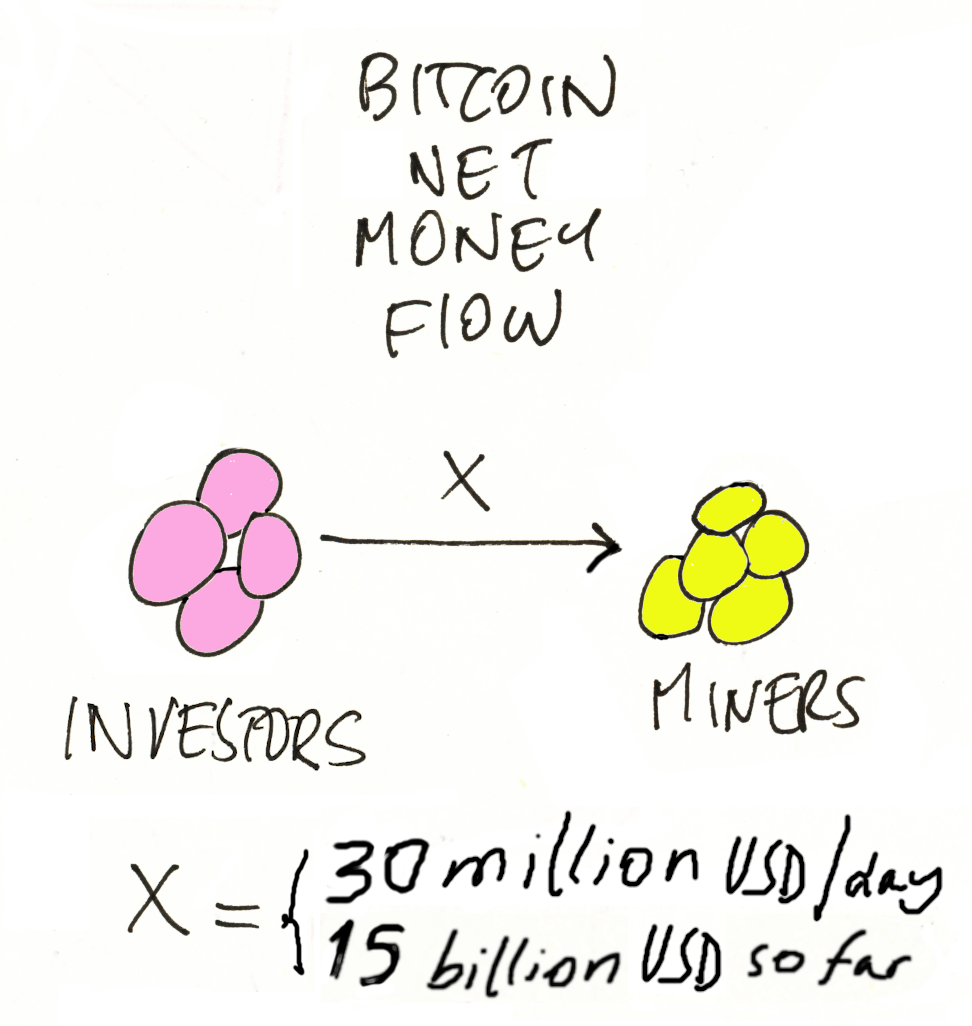

In summary, Article A fails to refute the thesis that investing in bitcoin is a ponzi. In particular, it fails to address the main point of that claim: that bitcoin's money flow is exactly the same as that of a ponzi scheme, as depicted below:

The arrow in that diagram represents the net one-way flow of money from investors to miners. The net total flow since 2009 is already 15 billion USD. If the the current BTC price holds, that amount will grow by about 30 million USD/day, or at least another 10 billion USD in the next year. Besides the investors, there isn't (and there will never be) any source of money that could return that money to them.

Even if bitcoin promoters refuse to accept the label "ponzi", they cannot deny that diagram. How can anyone propose such a bottomless barrel as a "store of value" is beyond me.

Actually, a rebuttal of the "ponzi" thesis comprises only a part of Article A. A good part of its is devoted to implicit promotion bitcoin investment, with the same misleading and fallacious arguments that bitcoin promoters have been using for a decade. In particular, Article A insists that the flavor of bitcoin that is managed by the "Core" development team (BTC) is the only sound cryptocurrency -- a thesis known as "Bitcoin Maximalism".

Article A also spends a good many words to explain that bitcoin is absolutely, completely, totally different from Ripple's coin (XRP), that has now been accused by the SEC of being an illegal security.

This section addresses the points of Article A that are directly relevant to the "ponzi" thesis.

"Here is how the US Securities and Exchange Commission defines one: 'A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors.'" That is a good definition; it is basically item 4 of mine -- and therefore it is broader than mine. That is: if something fits my definition of ponzi, it automatically fits SEC's definition too.

"[SEC:] Ponzi scheme organizers often promise to invest your money and generate high returns with little or no risk." Note the word often. It implies that this sentence is no longer part of the definition; it is just a description of what typically -- but not necessarily -- happened in previous ponzis.

As I discussed in my Article S, an explicit promise of profits is not a necessary condition. In fact, the most successful ponzis -- like Madoff's fund -- carefully avoid making such promises, because they are a dead giveaway.

Instead, ponzi operators need only create the expectation of high profits in a sufficient number of victims. Which thousands of bitcoin promoters have been doing with great zeal and energy for the past 10 years or so. Article A itself, while not explicitly advising people to invest in bitcoin, is unequivocally praising it, e. g. by suggesting that "institutional investors" are generally jumping in.

Unfortunately, millions of dollars are now being spent marketing bitcoin by the few large "whales", like MicroStrategy, that recently invested into it; and by the companies, like Fidelity and Grayscale, that did not invest but created custodial funds and various other mechanisms in order to profit from its investors.

"[SEC:] But in many Ponzi schemes, the fraudsters do not invest the money. Instead, they use it to pay those who invested earlier and may keep some for themselves." Again, note the word many, that clearly excludes this sentence from the definition. However, this sentence is in fact stating conditions 3, 4, and 5 of my definition -- which are fully satisfied by bitcoin investment.

"there are no 'issues with paperwork' or 'difficulty receiving payments' ... some of the SEC red flags of a Ponzi" This is downright faulty logic: "a baklava and a machine gun are red flags for a criminal. This guy does not have them therefore he is not a criminal."

"Unregistered Investments and Unlicensed Sellers: The only items on the [SEC's] red flag list that may apply to Bitcoin are the points that refer to investments that are unregulated. This doesn’t inherently mean that something is a Ponzi; it just means that a red flag is present and investors should be cautious." This is a reversal of the bad logic of the earlier item, where the lack of a certain red flag was presented as "evidence" that bitcoin is not a ponzi.

Indeed investors should be cautious, because no bitcoin market -- not even the "regulated" US exchanges like Coinbase and ItBit -- is subject to any of the regulations and monitoring that apply to other financial markets, such as stock exchanges and futures trading.

Years ago the SEC decided (incorrectly, in my view) that cryptocurrencies are not securities, and therefore outside of their concern (except for certain ICOs and coins that are too obviously patterned after securities, like XRP.) As a result, there is no agency in the US that monitors or regulates the trading of cryptocurrencies, whether in open markets (exchanges) or the over-the-counter market (through private brokers). FinCEN and other agencies regulate the US-based exchanges and brokers, but only their handling of customers' real money deposits, and their compliance with KYC requirements. The situation is similar in the many other countries that slavishly imitate the US in the regulation of their financial sectors.

As a result, cryptocurrency exchanges and brokers are free to use many practices that are highly lucrative for them but would be serious crimes in the securities markets. They include wash trading (the exchange trading with itself to pump up price and/or volume), front-running (retroactively inserting its own trades between low asks and higher bids), trading against its clients, and buying bitcoins with non-existent money. There is strong suspicion that the last type of fraud is occurring in a massive scale -- 21 billion USD so far -- by means of the Tether-issued pseudo-dollars (USDT). Indeed, it was this exposure to massive price manipulation that led the SEC to reject several proposals for bitcoin-based electronically-traded funds (ETFs) in the past.

This lack of any significant market regulation also made possible a kind of fraud that is unheard of in regulated securities markets: the sudden collapse of cryptocurrency exchanges, with loss of all coins in their customers' accounts. MtGOX, Criptsy, Virtex, Quadriga, Cryptopia... The list of such "exit scams" is too long to compile [5].

Therefore, investors should really heed Article A's advice: when considering whether to invest in bitcoin, they should use the same caution they would use before investing in tickets of a North Korea based lottery that does not publish either prizes or odds.

"Some SEC officials have said that Bitcoin and Ethereum are not securities (and by logical extension, have not committed securities fraud)." Even if we accept that extension as logical, the problem is that the SEC can (and, I am sure, eventually will) change its mind. That is what happened to the very example that Article A cites -- XRP, created by Ripple Labs. Until recently, the SEC had classified it as a cryptocurrency, and therefore outside its mandate. But then it changed its mind, and recognized it as a security -- which automatically made its creation a securities fraud.

"The IRS treats Bitcoin and many other digital assets like commodities for tax purposes." It is not the job of the IRS to decide whether something is a fraud or not. If you make a profit by trading unicorn oil pills that make hair and noses grow, the IRS would consider that a commodity and tax your gains accordingly.

"The argument suggests that because the Bitcoin network is continually reliant on new people buying in, that eventually it will collapse in price as new buyers are exhausted." Indeed, the first part is a fact, and the second part is a logical consequence of it.

"The broadest definition of a Ponzi scheme refers to any system that must continually keep operating to remain functional, or that has frictional costs." That "broad definition is quite wrong, and it is a red herring. Bitcoin nicely fits the narrow definition of the SEC, and my even narrower one. There is no need for a broader definition.

"Bitcoin’s Launch Process" This lengthy section is totally irrelevant, because the origins of an enterprise do not matter for its analysis as an investment. Enron, Theranos, and OGX started as very legitimate companies, with the intention of generating real profits through productive activities. But, eventually, they became no better investments than thoroughly fraudulent enterprises like ZZZZ Best.

"[Satoshi's whitepaper] ... contained no promises of enrichment or returns." True, Satoshi did not intend to create a ponzi. No one is claiming that he did. In fact, he left the scene a few months after the coin became object of speculation. And, again, a promise of returns is not a necessary feature of a ponzi.

But, more importantly, what Satoshi did or did not do is irrelevant. This comment tries to misdirect the discussion by implying that Satoshi would be the operator of the alleged ponzi. Obviously not. The operators of the bitcoin ponzi are the miners and mining pools, who keep the network going and "keep some investor money for themselves"."[Satoshi's whitepaper] provided a solution for well-known computer science challenges related to digital scarcity." No, "digital scarcity" was not a "computer science challenge"; and Satoshi's protocol was not meant to "solve" it. The challenge he believed to have solved was designing a payment system that was decentralized -- meaning that two parties could transact without having to trust some central third party.

Satoshi was quite naive in economic matters, but he surely knew that another unproductive and unbacked investment instrument was something that the world absolutely did not need.

"No Pre-Mine" This entire section too is irrelevant. A ponzi scheme does not depend on anything like a "pre-mine". Most historic examples did not, including Ponzi's and Madoff's.

Apparently, the goal of that section of Article A was not to refute the ponzi claim, but only to assert that bitcoin is better than other cryptocurrencies (and especially XRP) because "it did not have a pre-mine". Which is not really true: while it may not have been intentional, Satoshi did end up mining 5% of all the bitcoins in existence today, at very little cost, before other miners entered the scene. But, again, that is a separate issue.

"The blockchain is public, transparent, verifiable, auditable, and analyzable." These claims are irrelevant to weather investing in bitcoin is a good idea, or whether it is a ponzi. Pyramids, lotteries, and multi-level marketing (MLM) schemes are transparent too. Lotteries are supposed to be audited and verified, and the others could be too without spoiling their "business".

"Open Source: The Opposite of Secrecy ... Most Ponzi schemes rely on secrecy. ... This secrecy prevents the market from appropriately pricing the investment until the secret gets found out. ... Bitcoin, however, works on precisely the opposite set of principles ... every line of code is known ... A [relay node] can audit the entire blockchain and the entire money supply." This is another attempt to misdirect the reader by equating openness of the payment system's mechanism to investors' awareness of the money flow.

The blockchain shows only the movement of bitcoins between addresses. It does not give any clue about the transfer of money between investors and operators. Madoff could have published his fund's ledger, showing the share of the fund that each investor owned, and the full history of its changes, so that anyone could verify that the fund shares were correctly assigned. It would have been more informative than the blockchain -- but would have made no difference to the ponzi's operation or success.

Lotteries, pyramid schemes, and MLM schemes too have completely open mechanisms -- but are still scams. Like bitcoin, they do not rely on lies, but on ignorance and obfuscation. Lotteries target "investors" who are unable to understand probabilities and the concept of "expected return", and are misled by seeing that some people become millionaires by playing. Pyramid and MLM schemes target those who cannot grasp the consequences of exponential growth of the member base. And the bitcoin investment scam targets those who are unable to see its totally ponzi-like money flow, or understand its implications.

"Leaderless Growth: [Bitcoin] flourished without centralized leadership" Again, the existence of a "leader" is not necessary for something to be a ponzi. The SEC definition does not require one. It is true that most previous ponzis indeed had a single well-identified "leader", who was also both the "creator" of the scheme and the "operator" who kept its ledger and pocketed a large slice of the invested money. But that was an incidental feature, not an essential one.

Others who have pointed out the ponzi-like nature of bitcoin investing have qualified it as "naturally occurring" or "decentralized" ponzi. Leaderless scams are not new. The original pyramid schemes were executed by mail, as "chain letters", without any involvement of the creators. In MLM schemes, the victims themselves do most of the promotion and recruiting, without direction or planning from the organizers -- who merely collect the contributions and dole out the rewards.

"With Bitcoin, miners invest into customized hardware, electricity, and personnel ..." Whether the miners deserve their revenue, and what they do with it, are completely irrelevant. The important fact is that they take a good chunk of the investors' money, and will never give it back.

"Bitcoin relies on the network effect, meaning a sufficiently large number of people need to view it as a good holding for it to retain its value. Bitcoin’s price has grown rapidly ... as its network effect continues to compound while its supply remains limited." The "network effect" would be a relevant concept if bitcoin's primary use was to process payments. Indeed, the utility of a payment network is more than proportional to the number of users. However, even its staunchest supporters now dismiss that use, insisting that bitcoin's goal is to be just a "store of value".

The corresponding concept in the realm of investments -- a large number of people investing in something because they see many other people doing the same -- is called a "bubble"; and, while it raises the market price, it does not add anything to the item's real value.

Bitcoin's market is, almost by definition, dominated by "investors" who do not understand the basics of investing: who do not know why stocks or gold have value, who believe that national currencies are ponzis while bitcoin is "sound money", who think that past price history is an indication of future prices, and who cannot grasp the fact that the money flow of the bitcoin "investment" game is exactly that of a ponzi scam. They cannot understand that the paper value of their coins is not real until they sell, and that their investment should be counted as loss until then.

Many of those investors are convinced that the market price of bitcoin will "go to the moon" in some indeterminate future, and will continue to invest all their spare money, e. g. after "dollar cost averaging". Those hard believers kept the ponzi going even in those months of 2018 when the price was 80% below the all-time high.

Through most of its history, bitcoin's market price has depended primarily on those clueless investors -- specifically, on their feeling about their future feeling about their future feeling ... in an endless speculative recursion.

The investors also include a number of criminals, who collect bitcoins for use in illegal payments, or as result of illegal activities like ransomware. It also includes many scammers who recognize the ponzi nature of the game, but think that they can win at it, by exiting at the right time, and thus take many millions of dollars from the poor suckers above.

"[Bitcoin is] backed up by decentralized consensus around an immutable public ledger ... If the market continues to recognize it as a useful savings and payment settlement technology" Even if bitcoin were a useful payment technology (which it isn't), that usefulness would not translate into revenue for investors. Unlike the revenue from services provided by companies, the fees collected by miners for processing payments are not shared with the holders of bitcoins. Unlike the consumption of commodities, the use of bitcoins for payments does not result in consumption (removal from the market).

"Bitcoin will only be successful in the long run if its market capitalization reaches and sustains a very high level. [...] If for some reason demand for it were to permanently flatline and turn down without reaching a high enough level, Bitcoin would remain a niche asset, and its value, security, and network effect could deteriorate over time." It is much worse than that. Bitcoin's success -- like that of any ponzi, pyramid, or MLM scheme -- depends critically on perpetually increasing price, which both requires and drives continuous net investment. That is, investors must be continually spending more money acquiring bitcoins than they are receiving from its sale. While there may be still space for the price to rise further, the game must eventually end -- and then all investors will realize that their net input of tens of billions of dollars were not "investment" but pure loss.

"[Bitcoin's] security (hash rate) is inherently connected to its price." More precisely, the security of the ledger is entirely dependent on the price of the coin. It is a common misconception that the work done by the miners is somehow "stored" in the bitcoins themselves. In fact, once some bitcoin amount is moved, all the work already spent by the miners is irrelevant: the security of those coins -- more precisely, of that transaction -- depends only on the amount of work spent by the miners after its confirmation.

"Every investment has risks" Not quite true: some investments are risk-free because they are obviously scams.

"A bitcoin is like a commodity, in the sense that it’s a scarce digital "object" that provides no cash flow, but that does have utility." This sentence contains four errors: a true commodity will provide a cash flow, bitcoin is not really "scarce", it has negligible utility, and is not at all like a commodity.

A commodity must have producers, who supply it to the market, and consumers who take it permanently out of the market. Then the theory of markets applies, and says that the price will be the point where the producers' price x supply function intersects the consumers' price x demand function.

Speculators or middlemen, who buy the commodity for re-sale rather than consumption, will modify those functions and hence change the price away from that "natural" value. But these distortions are highly volatile, since they depend entirely on the feeling of the speculators about future prices.

Bitcoin has producers (the miners), but has no consumers: all coins that have been created are (and forever will be) conceptually in the market, even if they are stored in the private wallets of the "hodlers". It follows that its "natural" price as a commodity is zero. Its market price is 100% speculative overpricing -- that is, entirely dependent on the investors' feelings about their future feelings about their even later feelings... which explains its exceptional volatility.

"Specifically, [Bitcoin] is a monetary commodity; one whose utility is entirely about storing and transmitting value." There is no such thing. Commodities that have been used for money all had an "intrinsic" value as a commodity, created by a consuming demand, which was the basis for their monetary value. Even the rai stones of Yap, which are commonly advanced as an example of a form of "money" with purely conventional value, had in fact an intrinsic value, because they were made of a stone with beautiful appearance that was almost non-existent in the island.[6].

"By similar logic [used by critics], gold is a 5,000 year old Ponzi scheme." This section is a mishmash of misconceptions and misleading observations. As explained in my Article S, gold fails to satisfy the definition of ponzi.

Gold is primarily a commodity with a substantial and dependable consuming demand. Currently, about 2/3 of gold's production (2100 tons in 2019) is bought for use in jewelry and other decorative or utilitarian uses. Gold also has a large speculative demand, by people who buy it with intent to re-sell, mostly for "store of value" purposes. This speculation has inflated its market price to many times its "natural" price as a commodity. But the speculative demand would not exist without this basis.

"[Gold's] unique properties ... made it continually regarded as being optimal for long-term wealth preservation and jewelry across generations: it’s ... pretty, malleable, ... and nearly chemically indestructible." Again, lumping the jewelry and store of value uses is misleading. Indeed, those properties of gold -- plus its ability to be welded by hammering, its electrical conductivity, and more -- are what created the the demand for jewelry and industry. That demand, and its relative scarcity, are what made gold valuable; and this in turn made it a viable store of value. Its permanence and high value per weight also made it a viable form of money (but definitely not the "best" or "standard" one).

"Gold [is Bitcoin's] closest comparison. ...[Like gold,] Bitcoin relies on the network effect, meaning a sufficiently large number of people need to view it as a good holding for it to retain its value." And this is the great lie that the false statements about gold are meant to lead to. Sorry, but nothing can retain a value for long based only on common belief that it has value.

"By the broadest definition of a Ponzi scheme, the entire global banking system is a Ponzi scheme." This whole section too is irrelevant and misleading. Indeed, this is one of the most cringe-worthy tropes used by bitcoin promoters to convince people to give them their "worthless" dollars in exchange for the "valuable" digital donut holes that they are generously willing to sell.

As I explained in Article S, a national currency like USD or JPY does not fit the definition of ponzi for multiple reasons. There is no expectation of profit by "investing" in it. There are no profits paid off to those who choose to "cash out". Thus the new "investment" money is not used to pay off those non-existent profits; and the operators of the "scheme" do not take a fat slice of that "investment" money.

And the same objections apply to the attempt to cast "the entire global banking system" as a ponzi scheme. No one expects to make a profit by depositing money in a bank, there is no profit paid to those who cash out, etc. etc.

National currencies and bank accounts are clearly not meant to be investments, and therefore it makes no sense to compare them to investments. This line of argument is like claiming that a dead rat is a better paperweight than a chair, because chairs are disgusting.

"The banking system is a permanent round of musical chairs. There are more kids than chairs, so they can’t all get one. If the music were to stop, this would become clear." No, banks are not musical chairs. People who deposit money in them CAN get all their money out. Just not all at the same time. Bitcoin, on the other hand is totally a game of musical chairs -- with 15 billion more "kids" than "chairs". This is quite clear to anyone who is willing to see.

"[It is claimed] that because Bitcoin has frictional costs, it’s a Ponzi scheme. ... however, Bitcoin is no different in this regard than any other system of commerce. A healthy transaction network inherently has frictional costs. Bitcoin’s frictional costs are fairly modest compared to the established monetary system" The arrow in the money flow diagram above is not "frictional costs", like stock trading fees. The miners currently take 30 million USD/day, to process less than 400'000 transactions per day -- that is, an average cost of over 80 USD per transaction. That includes even transactions that just move coins from one pocket to another. The users of the system do not see that cost, because it is wholly paid by the "investors" who buy coins -- without their knowledge.

"The [bitcoin] narrative has changed and expanded as time went on" Indeed, the "narrative" of bitcoin's value has changed every time the falsity of the previous one became too obvious to ignore. It was originally supposed to bypass bank and government barriers, allowing payments for banned items and donations to banned organizations. Then, after markets like Silk Road were taken down, it was redefined as a competitor for Visa. When it failed at that goal too, it was relabeled as the ideal vehicle for international remittances, then as the way to "bank the unbanked", then as the "settlement layer" for a promised two-layer network, ... and is currently presented as a "store of value", a "digital gold".

"Secondary layers can ... reduce [bitcoin transaction] fees further. For example, the Strike App aims to become arguably the cheapest global payments network, and it runs on the Bitcoin/Lightning network." Yes, the Lightning Network would alleviate one of the many flaws of bitcoin -- if it could be made to work. But it cannot. It was supposed to make bitcoin scale to hundreds of millions of users, but in fact it scales even worse than raw bitcoin.

And, by the way, if the LN could be made to work, it would work with any cryptocurrency, not just BTC. In fact, it would work better with almost any other crypto, like BCH (Bitcoin Cash). than with BTC: because the intentional congestion of the latter could cause excessive delays and/or excessive fees that could severely degrade the performance of the LN, or even compromise its alleged security.

As for Strike, for now it is just the promise of a dude. (He referred to it, in an interview, as a "bitcoin neo-bank". I suppose that he is too young to remember Neo -- the first "bitcoin bank" that Daniel Brewster had launched in Cyprus, with much more fanfare, a few years ago.)

"several [readers of Satoshi's whitepaper] could have been technical enough to "steal" the project from him" This discussion is bizarre. The whole point of publishing the paper was to share the idea with the world.

In fact, Satoshi must have been very disappointed by the complete indifference that computer scientists and professionals showed to his "solution" for the old problem of building a decentralized payment problem -- a rejection that has only become worse in the past 12 years [4].

"[Satoshi's whitepaper] provided a solution for well-known computer science challenges related to digital scarcity." In fact, Satoshi did not intend to create bitcoin itself. In the whitepaper and in two years of posting to Bitcointalk, he only mentions the currency a handful of times. His intention was to create a decentralized payment system. If he could have used national currencies like USD or EUR, he surely would have done so: it would have made the system infinitely more useful and easier to use. He created a new currency only because he could see no way to do that.

Indeed, from those few times that he discusses the currency, it is clear that Satoshi understood that the dependency on a new fiat currency, with no central bank to stabilize its value, was a flaw of his system. In those posts, especially in the long one about how bitcoin could acquire value, he is clearly trying to argue that flaw away (and showing how superficial his knowledge of money and economics was).

"Satoshi ... mostly wrote about technical aspects, about freedom, about the problems of the modern banking system, and so forth." Satoshi wrote almost exclusively about technical aspects of the payment system, period. In two years of postings, he wrote only two or three ambiguous sentences about "freedom". As for "the problems of the modern banking system", he wrote in the whitepaper that "it works well for most purposes", and that the level of privacy that it provides is an ideal that bitcoin can only approach -- if used with care.

"No central authority can change [the code]." This is just not true. See how Blockstream imposed the SegWit change, that had no value for anyone except the company. Or how Vitalik and a few miners changed the code of Ethereum, breaking its most sacred premise, in order to recover money that they had lost to the TheDAO hacker.

"Leaderless Growth" While irrelevant to the ponzi question, I must point out that the "leaderless" claim is quite incorrect for bitcoin. Every cryptocurrency has a specific "dev" (development) team, that has control over the "official" version of the software, prepares its inevitable updates, and usually has enough "moral power" to impose substantial changes to it.

The effective leader of classical bitcoin (BTC) seems to be Blockstream, a private company that conceived and pushed the SegWit reform and decided that its block size would remain fixed at 1 MB (plus up to 3 MB of segregated signatures).

One person in the dev team holds the password that enables him or her to actually modify the source on the "official" source repository. For bitcoin, this person was Satoshi for the first two years, then Gavin Andresen from 2011 to 2014, and Wladimir Van Der Laan from 2014 to the present. Wladimir is an employee of the Digital Currency Initiative (DCI), a research project hosted by MIT's Media Lab and financed by unknown private donors; but he has regularly accepted any changes that Blockstream wanted, and rejected those it did not want.

By having control (through Wladimir) of the "official" source code, Blockstream has also substantial control over the layer of "full but not mining" relay nodes that was added to the protocol in 2011-2012, after Satoshi had left -- an "improvement" that totally broke bitcoin's security. Typically, a user connects to the mining network through a set of relay nodes that ultimately derives from a few "seed nodes" hard-coded in the official implementation. That feature enabled the UASF threat that, in 2017, forced the Bitmain mining company to accept Blockstream's SegWit reform.

"Hal Finney passed away in 2014.... The distributed development community ... " This and other references to "other developers" may lead the reader to think that the bitcoin dev team was an open community where everyone had equal footing. It never was. While volunteers could propose changes, the Core dev team led by Blockstream, and ultimately the repository key holder, had sole authority over the software.

"The market clearly has preferred Bitcoin’s base layer to optimize for being a store of value and large transaction settlement network, to optimize for security and decentralization, with an allowance for frequent smaller transactions to be handled on secondary layers." The market did not really opt for any of that. Blockstream decided the switch to the two-layer model in 2014, without consulting anyone, and imposed that vision with the force of its 70 million USD of venture capital and support of other entities (such as the CoinDesk "news" website) financed by the same VC investors.

Very few if any of the bitcoin investors could understand the technical arguments for and against increasing the block size limit. (Blockstream and the Core dev team themselves clearly did not.) In 2017, when a dissident dev team split the coin, Blockstream retained the unqualified name "Bitcoin" and the "BTC" ticker for its branch. That, and Blockstream's financial muscle, are enough to explain the difference in market prices.

"Prospective investors can analyze the metrics of Bitcoin’s network effect, and determine for themselves the risk/reward of buying into it." That would be good advice, except for one detail: there is no meaningful and reliable estimate, even within an order of magnitude, for any measure of said "network effect".

We can assume that most of the 18 million bitcoins issued so far are in the hands of "hodlers". We can estimate the net money lost by the investors so far, as above (about 15 billion USD). And that is it. We have no idea about the number of actual users, volume of actual payments, nature of traded goods and services, etc -- not even totals, much less distributions by country, age, etc. We know a lot more about the North Korean nuclear program than about the "bitcoin economy".

Bitcoin promoters routinely quote many impressive numbers, like the 600 billion USD market cap, 400'000 transactions confirmed per day, 4 billion USD transferred per day [7], millions of software downloads, millions of exchange accounts, etc. However, none of those numbers is meaningful.

For instance, not every transaction (coins moving from one address to another) is a payment (coins being sent to a different owner in exchange for goods or services). We know that many transactions are not payments. Each illegal payment is typically sent through a mixing service, that will mix, split, and transfer those coins thousands of times, in the hope of evading the cops. Many transactions are deposits or withdrawals from exchanges, conversion to other currencies, wallet reorganizations, hot-wallet/cold-wallet transfers, or even just spam (as in the "stress tests" of 2015, that clogged the network for days). All those non-payment transactions are counted as "payments" in those statistics. True payments may be a tiny fraction of them -- and legal payments may be a tiny fraction of that.

An interesting statistic counts the number of blockchain addresses according to the amount that they contain [8]. It says, for instance, that about 800'000 addresses (2% of the total) hold 95% of the 18 million extant bitcoins; and that there are 13 million addresses that contain more than $100 worth of bitcoin. Unfortunately, these numbers too are hard to interpret. On one hand, some addresses may belong to custodial entities like exchanges, and thus may hold coins belonging to many different people. On the other hand, the recommended practice of never reusing addresses means that a single user may own dozens or hundreds of addresses.

While not directly relevant to the question of whether bitcoin is a ponzi, this complete lack of data about the "bitcoin economy" should be a concern for those who may consider investing in the coin because of its alleged utility.

"[It will reach] some mature market capitalization of widespread adoption and lower volatility." Market capitalization of bitcoin has nothing to do with widespread adoption. The number of transactions confirmed per day is now the same as it was 4 years ago, and cannot increase any further. So the increase in price cannot be due to increased adoption, but only to increased speculation.

The word "capitalization" is in fact wholly inappropriate since the number (600 billion USD) is wholly imaginary. The market cap of a stock can be taken to be the market's estimate of the value of the company, including all its assets and future profits -- which belong to the stockholders. In contrast there is nothing anywhere that is worth a penny of that amount and belongs to the holders of bitcoins. That number is only a measure of illusion: it is how much the bitcoin holders think that they have. In order to receive that amount, there would have to be an army of new investors willing to spend 600 billion dollars to buy their illusion.

Market capitalization (or market price) also will not cure its tremendous volatility. That is a consequence of the lack of any intrinsic value, so that the price is 100% due to speculation by a community of mostly irrational investors and day-traders.

"The year 2020 was a story about institutional acceptance, where Bitcoin seemingly transcended the boundary between retail investment and institutional allocations." Rather, 2020 was a year where bitcoin promoters made a great deal of a few big investors buying some bitcoin. It is reminiscent of Overstock and many other "institutional investors" that have been touted before.

Most of the "institutional investors" that "jumped in" last year are bitcoin custodial companies like Pantera and Greyscale, that buy and hold bitcoins for investors with their money, without any risk for themselves. Excluding those, the "institutional investors" are only a small handful.

The largest "institutional investment" by far was MicroStrategy. Its first purchase had several peculiar features, that leave way for many theories about its real motives. Suffices to note that Michael Saylor has 70% of the voting stock, but only 20% of the total stock; and that every dollar that MicroStrategy spent, beyond the miners' daily take, went to some early investor. The second purchase by MicroStrategy did not use the company's money, but -- like the bitcoin funds above -- was executed with other people's money, raised for that purpose.

"Bitcoin vs Fiat" By the way, bitcoin too is a fiat currency.

"Fiat currency is an artificial commodity, in a certain sense." Only in the "wrong" kind of sense. Modern national currencies are totally not commodities. They don't have a consuming demand, and their value is totally not determined by the laws of supply and demand.

"When we do work or sell something to acquire dollars, we do so only with the belief that its large network effect (including a legal/government network effect) will ensure that we can take these pieces of paper and give them to someone else for something of value." That is unfortunately a common misconception that is spread by cryptocurrency promoters, to mislead their victims into thinking that the value of the coins is as well-founded as that of dollars and euros.

That is totally wrong. A national currency has a stable value only because, and as long as, its central bank is willing and able to stabilize its value, through constant intervention in its circulating supply. Someone who accepts a dollar bill trusts that it will retain its value because he trusts that the Fed will do that job -- even if he does not know what the Fed is and what it does.

"If about 20% of people were to try to pull their money out of their bank at the same time, the banking system would collapse. ... That’s actually one of the SEC’s red flags of a Ponzi scheme: difficulty receiving payments." This argument is, er, rather perplexing. As Article A itself admits, of course banks lend out most of the cash that clients deposit, keeping only a small reserve to satisfy expected withdrawals. That is their function; that is how they get the revenue to pay their operating costs and the profit of their stockholders.

If you lend money directly to someone who is setting up a restaurant, you cannot demand the money back at any moment before the agreed-to deadline. If you buy stock of a company at its IPO, you cannot demand to receive immediately all your money back as dividends. It would be absurd to view that as a "red flag" suggesting that lending money or investing in stocks are ponzi schemes.

"Each individual unit of fiat currency has degraded about 99% in value or more over the multi-decade timeline." This is another old trope of "gold bugs" that bitcoin peddlers have adopted, for the same purpose: convince their victims to give up their dollars.

Yes, a yearly inflation rate of 4% per year means 99% loss in 120 years. But that number is relevant only if you just dug up the bank robbery loot that your great-grandparent "invested" into your backyard in 1900. In real terms, if you spend or invest your monthly salary during the following month, a 6% USD inflation rate means a "money holding tax" of 0.25%. That is, for each $1000 that your employer spends on you (after taxes and benefits), inflation will take $2.50. That is negligible compared to other taxes and the cost of just staying alive.

"[USD inflation] means that investors ... need to buy investments instead, which inflates the value of stocks and real estate compared to their cash flows, and pushes up the prices of scarce objects like fine art. Bitcoin is an emergent deflationary savings and payments technology..." Indeed, in an economic crisis the whole country, if not the whole world, sees their revenue and wealth reduced; and investments generally lose value. So the solution to the is to invest into a ponzi that gives you the illusion of enrichment, while giving all your money to the operators and earlier investors?

"DBS Group Holdings, for example, which is the largest bank in Singapore ... generates over 2.5 billion USD per year in fees. And that’s one bank with a $50 billion market capitalization." Those are wholly irrelevant numbers. It makes no sense to conflate the fees for money transfer with interest from loans and fees from other services. And it makes no sense to compare those numbers with the bank's market cap: one should instead compare them to the volume of the corresponding services.

"Wealthy investors store wealth in various items that do not produce cash flow, including fine art, fine wine, classic cars, and ultra-high-end beachfront property that they can’t realistically rent out." Fine wines have a consuming demand, so they can be analyzed as commodity investments. Luxury real estate too has a consuming demand -- even if it it can't be rented, the owners can live in them, full or part time, and thus receive some revenue in the form of service. As for fine art and classic cars, it is pointless to view them as investments, even if as "stores of value", because their prices are not amenable to meaningful economic analysis. The "investors" themselves seem to view such purchases as mere ostentation of wealth -- like lighting cigars with $100 bills.

"The vast majority of gold’s usage is not for industry; it’s for storing and displaying wealth. ... here are 60+ years of gold’s annual production supply estimated to be available in various forms around the world." Lumping the speculative demand and stockpile with those of jewelry is very misleading, because they have vastly different prospects for the future. The demand for jewelry (and industrial uses) is likely to remain stable for decades to come, and little of the gold locked into those uses is likely to return to the market, irrespective of its market price. The speculative demand, on the other hand, can easily vanish, or even reverse (with speculators selling more gold than they buy), in a relatively short time. This fact explains the historic volatility of gold prices (swinging from over 2000 to less than 350 USD/oz, in constant dollars). [9]

In my understanding, at the current price gold is a bad investment, because the speculative overpricing is near the historic height, and is thus more likely to go down than up. But investing in gold is not a scam -- unless people are driven to invest by misleading claims about its financial nature.

Bitcoin is a ponzi.

[1] Lyn Alden (2021): "Why Bitcoin is Not a Ponzi Scheme: Point by Point". Posted on 2021-01-11 at swanbitcoin.com, accessed on 2021-01-17.

[2] Lyn Alden and Jorge Stolfi (2021): "Motion: Bitcoin is a scam". Debate in Richard Yan's Blockchain Debate Podcast, episode 21, posted on 2021-01-01, accessed on 2021-01-17.

[2] Jorge Stolfi (2020): "Bitcoin is a ponzi". Web article first published on 2021-01-02, accessed on 2021-01-17.

[4] Nicholas Weaver (2018): "Risks of Cryptocurrencies ". Communications of the ACM, volume 61, issue 6, pages 20-24.

[5] Luke Parker, Aditya Das (2020): "43 bitcoin exchanges that are no longer with us". Web article at Brave New Coin, dated 2020-08-18, accessed on 2021-01-17.

[6] Various (2021): "Monnaie de pierre". ("Stone money", i.e. Yapese rai stones) Article of the French Wikipedia, accessed on 2021-01-17.

[7] Blockchain.com (2021): "Estimated Transaction Value (USD)". Active chart page, accessed on 2021-01-19.

[8] Bitinfo (2021) "Bitcoin Rich List". Active statistics page, accessed on 2021-01-19.

[9] Macrotrends (2021) "Gold Prices - 100 Year Historical Chart". Active statistics page, accessed on 2021-01-20.

Last edited on 2021-01-20 13:08:31 by jstolfi